Gain access and invest in exclusive collectibles. Curated. Digital. Transparent.

Timeless, a brand of New Horizon GmbH based in Berlin, is dedicated to the mission of becoming the European market leader in rare collectibles investments and making investments in collectibles accessible, affordable and tradable. One of the first companies in the world to do so, Timeless enables everyone to invest in collectibles and participate in their performance through the use of blockchain technology.

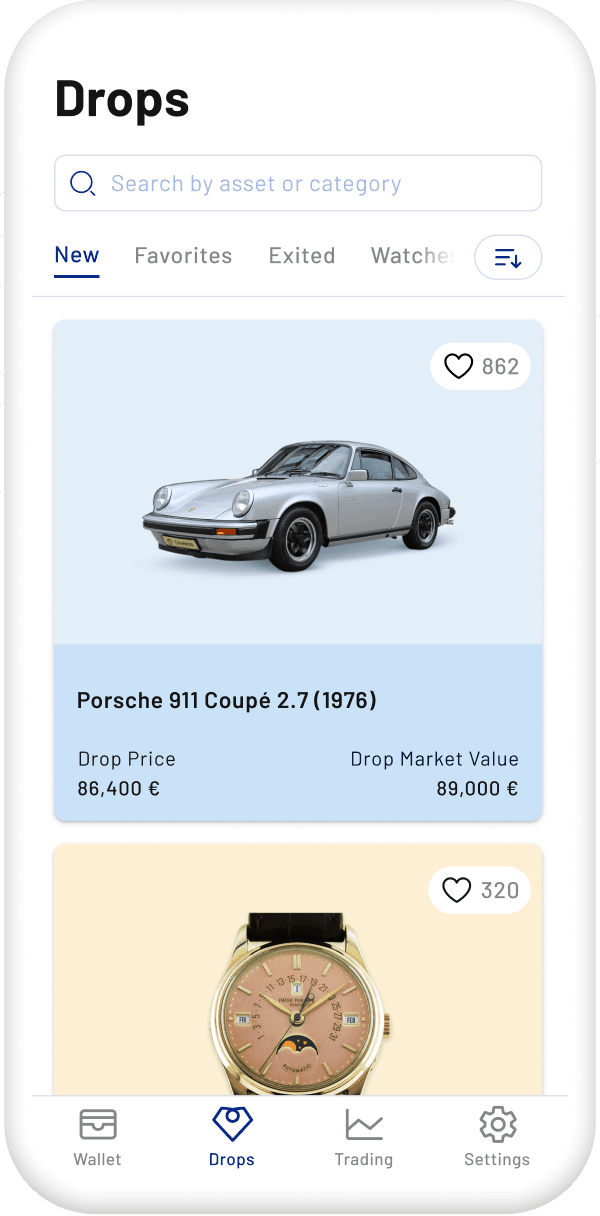

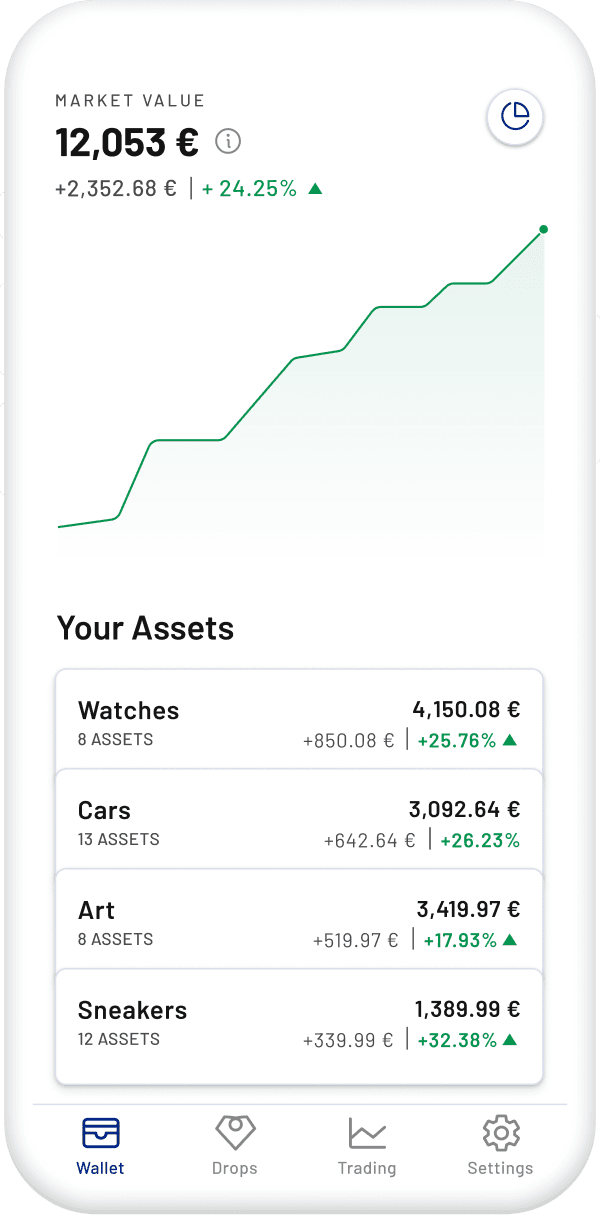

With its revolutionary business model, Timeless is democratizing the collectibles asset class and making the market of rare collectibles - including watches, art, vehicles, sneakers, wine, trading cards and memorabilia - accessible to all. To do this, Timeless uses blockchain technology, which documents digital transactions in a reliable, traceable and secure manner.

In addition, the company takes care of custody, insurance and maintenance until the assets are resold. The purchase of shares is secure, convenient and digital via the Timeless app.

Company | New Horizon GmbH |

Brand | Timeless |

Year of foundation | 2018 |

Location | Berlin, Deutschland |

Branch | Trade of Goods |

Team | 45 Employees |

Website | |

Investors | EQT Ventures, C3 EOS VC, Porsche Ventures, LA ROCA Capital |

Timeless uses data-driven processes and a network of experts to identify unique collectibles with high appreciation potential around the world, which are then verified and acquired.

Timeless then takes care of the optimal storage, insurance and maintenance of the collectibles until they are resold.

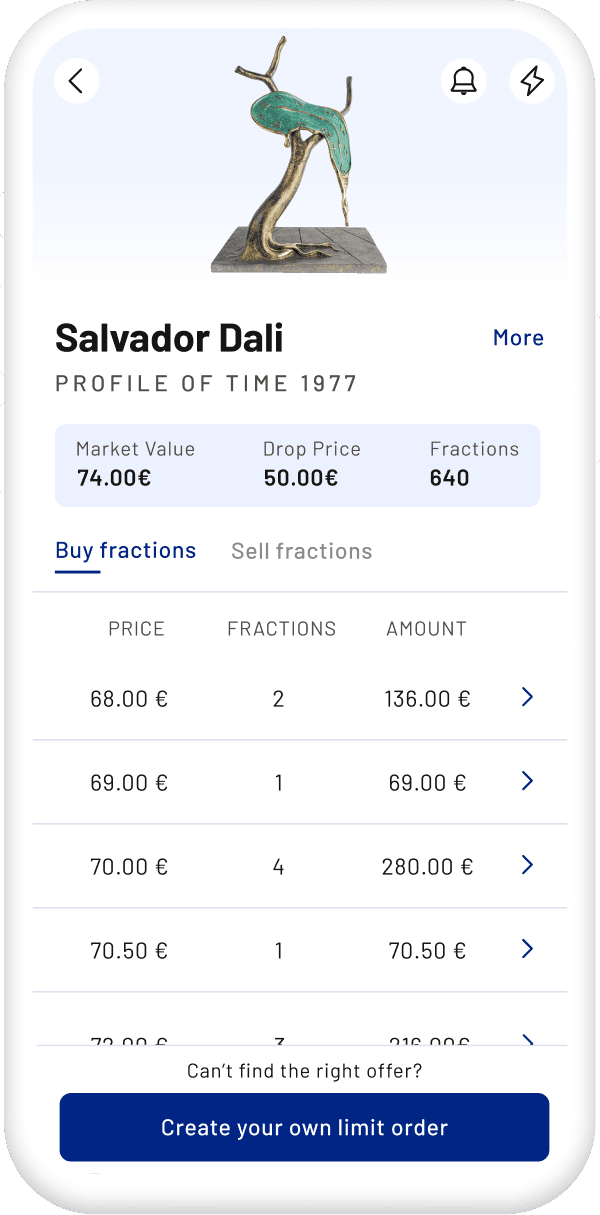

The Collectibles are divided into shares and offered for purchase via the Timeless app.

Investors can offer their own shares for sale, purchase shares and finally trade with other investors.

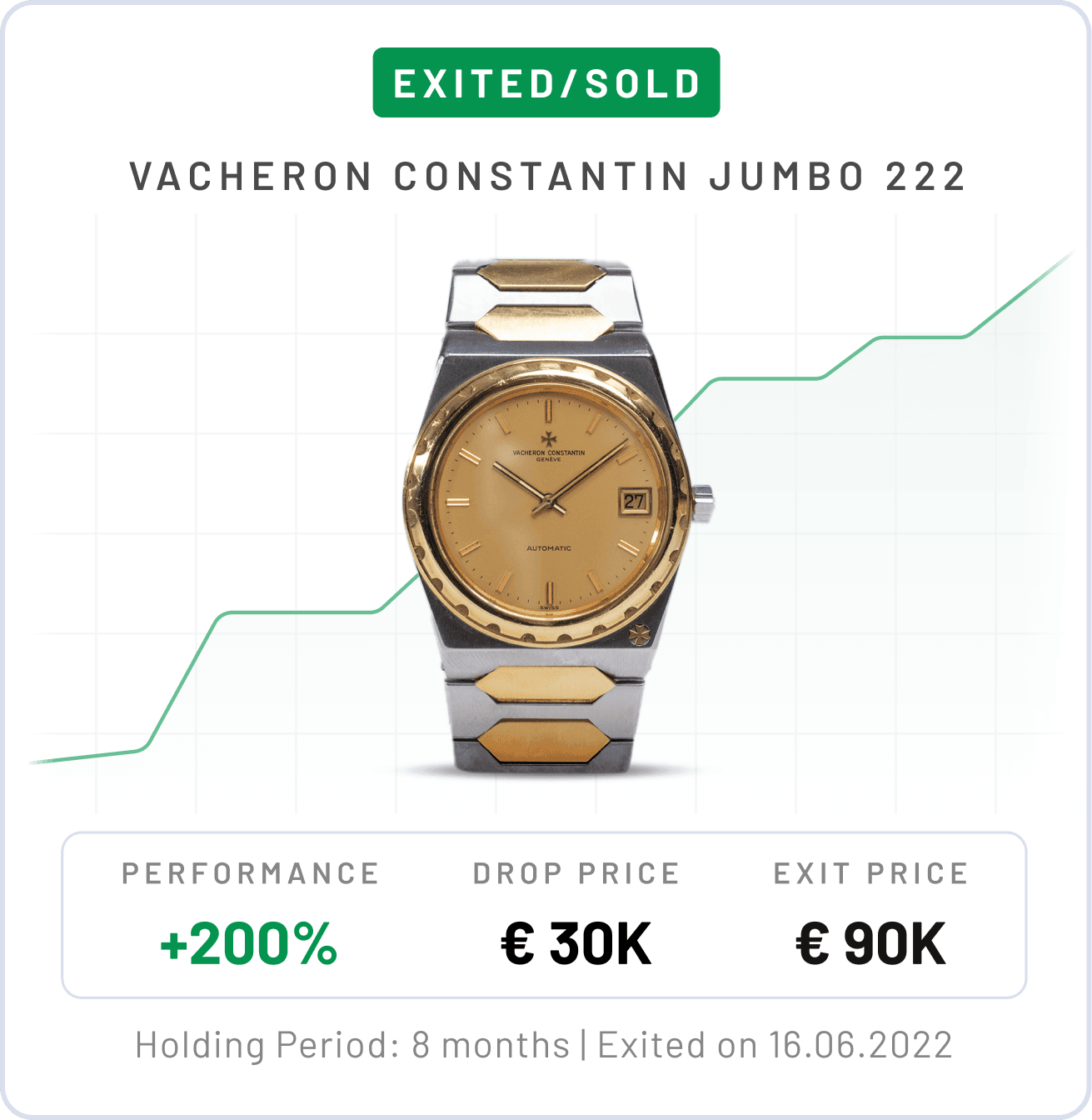

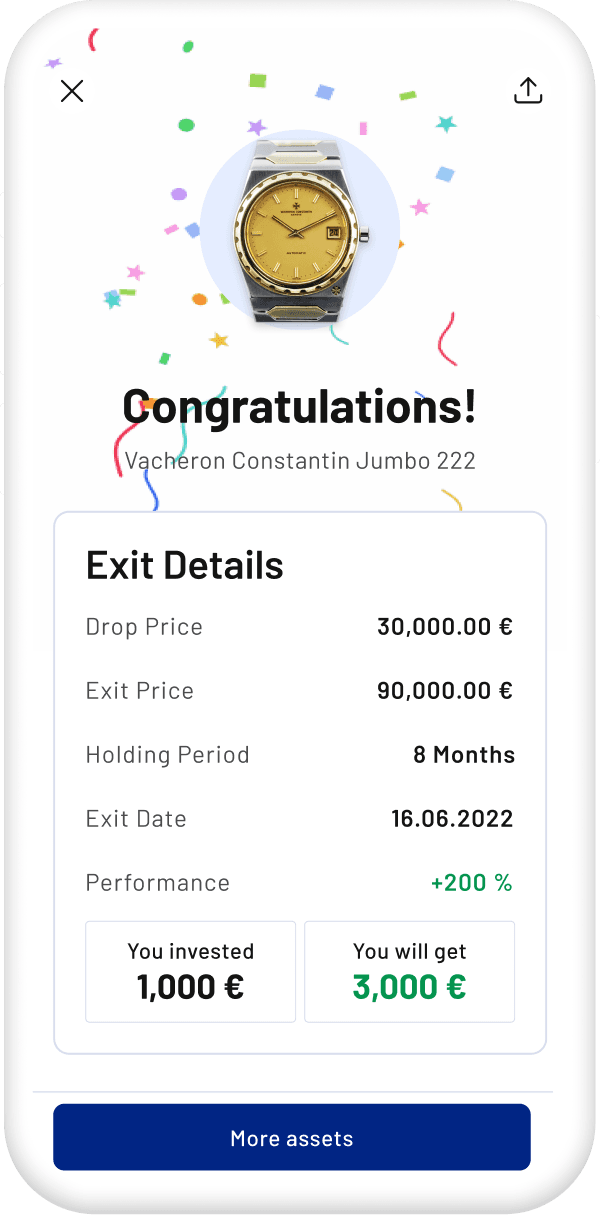

After a holding period, which typically varies by asset class (12 - 96 months, depending on market conditions), Timeless resells the collectibles, and shareholders are paid according to their shareholdings. However, in exceptional cases, if we have an attractive purchase offer, we may opportunistically sell Collectibles below a 12-month holding period.

After the purchase of the shares, the Collectibles belong to the shareholders according to the fraction they have purchased. In addition, Timeless is entrusted by the investors with the management of the collectibles until the time of the sale of the collectible. This fractional ownership model eliminates issuer risk and the Collectibles are owned directly by the investors.

Timeless itself holds shares in each asset (up to 5%), so we are a co-owner and have the same goal as you.

Timeless initially acquires the Collectible for its own account. After the fraction purchase, each fraction owner owns it directly at the fractional interest he or she acquired in it. That is, the fraction is contractually signed over to the purchaser and Timeless is charged with the custody, maintenance, and resale of the fraction. Thus, the fractions are no longer part of Timeless' assets and remain unaffected in the event of a possible insolvency. Details can be found in the master agreement, which can be viewed prior to purchase.

By the way, we've been around since 2018, we're a German GmbH based in Berlin, and Porsche Ventures, EQT Ventures and C3 EOS VC (the world's largest blockchain fund) are amongst our investors. Should we run out of funds the units of all users who have invested with us are protected in any case, as the units are transferred to the buyer.

Timeless undergoes an annual audit by an independent auditing firm. This comprehensive audit includes an accompanied inventory, during which the entire inventory of collectibles is checked for their existence. This ensures that the Collectibles are actually owned by Timeless. Proof of this can be requested from us.