For most of history, fossils belonged to institutions. They lived in museums, university archives, and behind locked laboratory doors. Then, everything changed.

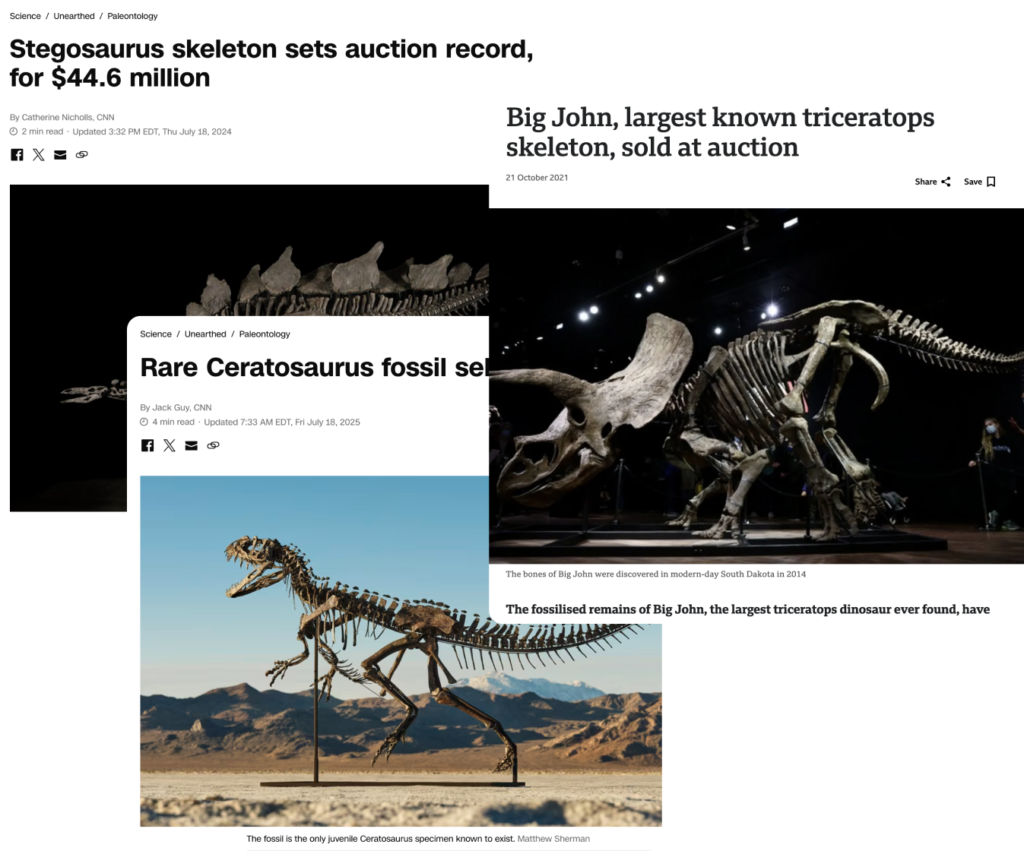

The world’s wealthiest individuals started bidding. In recent years, dinosaur fossil investments have broken records, including a Ceratosaurus fossil that sold for $30.5 million in 2025, and the highest price ever paid for a dinosaur: the Stegosaurus skeleton that fetched €40.8 million in July 2024 at Sotheby’s. A famous Triceratops named “Big John” also sold for €6.6 million in2021. The surprising part wasn’t the price; it was the bidders: private buyers, hedge fund managers, and tech founders.

They choose dinosaurs because nothing holds value like something that can’t be made again. Art can be commissioned, but a museum-grade dinosaur is one-of-one, created by time itself. Their supply is not limited; it is finished. This extreme scarcity defines Dinosaur Fossil Investment as a unique, high-value asset class.

While the current market boom feels sudden, the fossil auction market has been established for years. Occasional headliners since the 1990s, such as the auction sale of T-Rex ‘Sue’ in 1997 for c. $8.3 million USD, already proved that top specimens could trade at mainstream houses. This long development provides a more secure base for the category.

However, the market truly exploded after the 2020 sale of the T-Rex skeleton “Stan” for $31.8 million. This “Stan Effect” kicked off a powerful feedback loop, from headline prices to media attention to new HNWIs entering the fossil market, such as Ken Griffin (CEO Citadel) amongst others. Fossils were immediately pushed into blue-chip evening sales – the highest-stakes auctions reserved for top-tier assets – alongside fine art, triggering the Fossil Market Boom.

The boom is driven by three core forces:

Today’s fossil market has two clear structures:

The market’s long-term value is reinforced by the Museum Visibility Loop. When private buyers loan major purchases to institutions, the institutional display and research reinforce the asset’s scientific value. For example, the loan of ‘Apex’ the Stegosaurus to the American Museum of Natural History (AMNH) in New York significantly enhances its financial worth and legitimacy for future resale.

As an investor, you must approach this market with diligence, as the risks can be substantial. To protect your capital, you must aim for specimens that meet the “investment-grade” checklist:

Investment-Grade Checklist (What to Look For):

The story of fossil ownership has shifted from institutions to billionaires. We want to move it to everyone else.

The multi-million-euro barrier is removed through Fractional Dinosaur Ownership. We tokenized a 67-million-year-old Triceratops skull with museum-grade preservation (around 70% original bone volume).

This model makes investment safer and more accessible:

For the first time, the future of fossil ownership ‘isn’t only about who can spend the most’, but also who gets access.

The Dinosaur Fossil Investment market is an undeniable financial phenomenon driven by unrepeatable scarcity and global luxury demand. By focusing on investment-grade assets and rigorous due diligence, you can participate in this volatile, yet rewarding, market.

If you want to follow the journey of our Triceratops – from excavation site to restoration to fractional ownership – mark it as a favorite in the Timeless app. You’ll automatically join the waitlist and receive updates before anyone else.

The Triceratops Prorsus Skull drops December 2025.